Does Medicare Cover Long-Term Care and Assisted Living?

What are Long-Term Care and Assisted Living?

- Assisted living is generally a residential setting for people who need help with daily living tasks (activities of daily living, or ADLs) such as bathing, dressing, eating, toileting, or mobility, but do not require the 24-hour skilled medical care of a nursing home.

- Long-term care is broader: it includes both custodial (non-medical) assistance with daily living, and medical care over an extended period.

Many people assume Medicare will pay for assisted living or long stays in nursing homes; in reality, Medicare’s coverage is very limited.

What Medicare Does Cover Related to Assisted Living / Long-Term Care

Medicare may cover certain medical or skilled services even if you live in an assisted living facility, or need care that overlaps with what long-term care settings provide. The coverage tends to be short-term and under specific conditions. Key examples:

- Skilled Nursing Facility (SNF) Care

- If you have a qualifying hospital stay (usually 3 days inpatient), and a doctor certifies you need daily skilled care (e.g. physical therapy, intravenous medications, wound care) in a certified facility, then Medicare Part A may cover stays in a skilled nursing facility. Some Medicare Advantage plans waive the 3-day prior hospital stay requirement.

- There is typically a limit of up to 100 days per benefit period under these conditions. After that, Medicare no longer covers the SNF stay.

- Home Health Services

- Medicare may cover home health care if you are homebound, have a doctor's order, and need skilled services (nursing, therapy). These are generally short-term, acute care rather than constant custodial help.

- Medical Services While in Assisted Living

- Even in an assisted living facility, Medicare can pay for medical services you receive there: doctor visits, diagnostic tests, treatments, durable medical equipment, etc., assuming they are services and supplies that Medicare normally covers under Part A or Part B.

- Hospice Care

- If you are terminally ill and meet certain eligibility criteria, hospice care is covered, including needed medical care, counseling, drugs for symptom control, etc. This can occur in whichever setting is appropriate (including your home or a facility).

What Medicare Does Not Cover

There are many services and settings that people commonly assume Medicare covers, but it does not.

- Custodial Care

- This is non-medical care: help with daily living tasks (activities of daily living, or ADLs), such as bathing, dressing, eating, toileting, moving around, when medical treatment is not needed. Medicare does not pay for custodial care.

- Long-Term Residential Costs of Assisted Living

- Medicare does not pay for room and board in assisted living, or memory care, or ongoing personal or companion services in those settings.

- Long-Term Nursing Home Stays for Custodial Purposes

- If you’re going to a nursing home purely for custodial care (help with ADLs), Medicare won’t pay for that. If the care needs are medical or skilled and meet the SNF or home health criteria (hospital stay, etc.), then you might get some coverage, but only for a limited time.

- Assisted Living as a Primary Setting for Skilled Care

- Most assisted living facilities are not certified to provide skilled nursing care under Medicare rules. So even if you need skilled medical services, an assisted living facility may be unable to bill Medicare for it.

Common Misunderstandings

- Myth: Medicare pays for assisted living.

- Reality: Medicare may cover medical services while you’re in assisted living, but not the facility’s costs or custodial care.

- Myth: Medicare Advantage guarantees long-term care.

- Reality: Some plans may offer small supplemental benefits (like adult day care or in-home help), but they are limited.

Planning Ahead: Using Other Insurance Options to Prepare for Care Needs

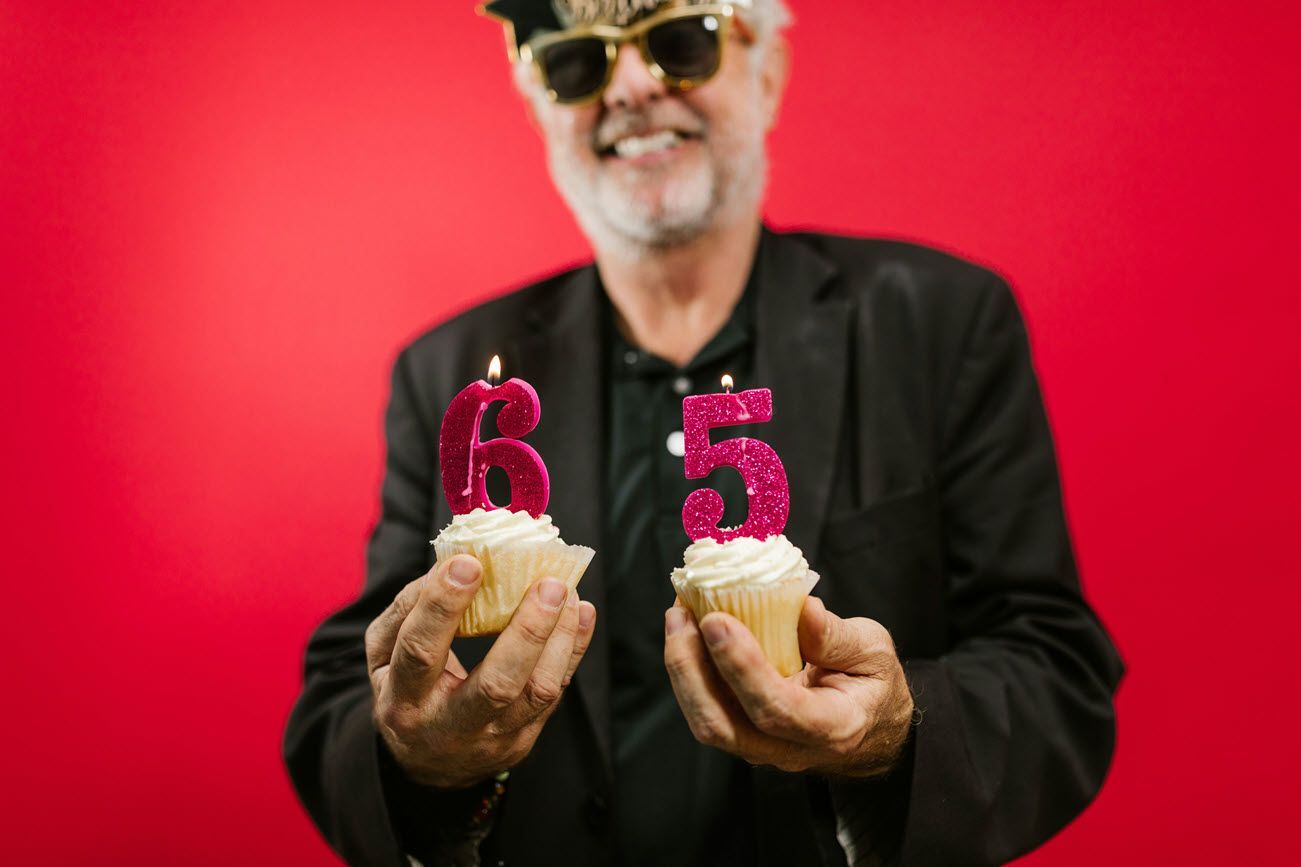

Since Medicare won’t cover most long-term custodial or assisted living costs, it’s important to plan before you need care. Private long-term care insurance can help cover nursing homes, assisted living, or in-home support, but policies are best purchased earlier in life (often in your 50s or early 60s) when premiums are lower and you are more likely to qualify. Some people also explore hybrid life insurance policies that combine a death benefit with long-term care coverage, or annuities with long-term care riders to help pay future expenses. Medicaid covers long-term care in certain situations; you can contact your local SSA branch to see if you qualify or to apply. Planning should include a realistic review of your finances, an understanding of your state’s Medicaid rules, and discussions with family about preferences for care.

The earlier you prepare—by considering insurance, savings strategies, and available community resources—the more options you will have if and when long-term care becomes necessary.

We are here to help! The best time to plan is NOW, and we are here to help you every step of the way.