Navigating Medicare: Why Partnering with a Trusted Agent Matters More Than Ever

As you approach Medicare eligibility, you're likely encountering a whirlwind of information, choices, and deadlines. The complexity of Medicare—encompassing Parts A, B, C, and D, along with various supplemental plans—can be overwhelming. Making uninformed decisions or missing critical enrollment periods can lead to costly mistakes, such as unnecessary expenses or gaps in coverage.

Dr. Katy Votava, a health economist and Medicare expert, emphasizes that "the big mistakes that people make in their Medicare decisions and choices can be very costly." She notes that many individuals end up with duplicative coverage or overspend on health insurance when they can least afford it. The anxiety surrounding Medicare's complexity often hinders decision-making, increasing the risk of errors.

While it's tempting to navigate Medicare on your own, the intricacies of the system—such as understanding the interplay between different parts, evaluating Medicare Advantage versus Original Medicare, and considering supplemental coverage—make it a challenging endeavor. Moreover, the lack of comprehensive guidance from employers during the transition from workplace plans to Medicare leaves many unprepared.

Working with a knowledgeable and trustworthy Medicare agent can alleviate this burden. An experienced agent can help you:

- Understand the differences between Medicare parts and what each covers.

- Evaluate the pros and cons of Medicare Advantage plans versus Original Medicare with supplemental coverage.

- Identify the most cost-effective prescription drug plans tailored to your needs.

- Ensure timely enrollment to avoid penalties and coverage gaps.

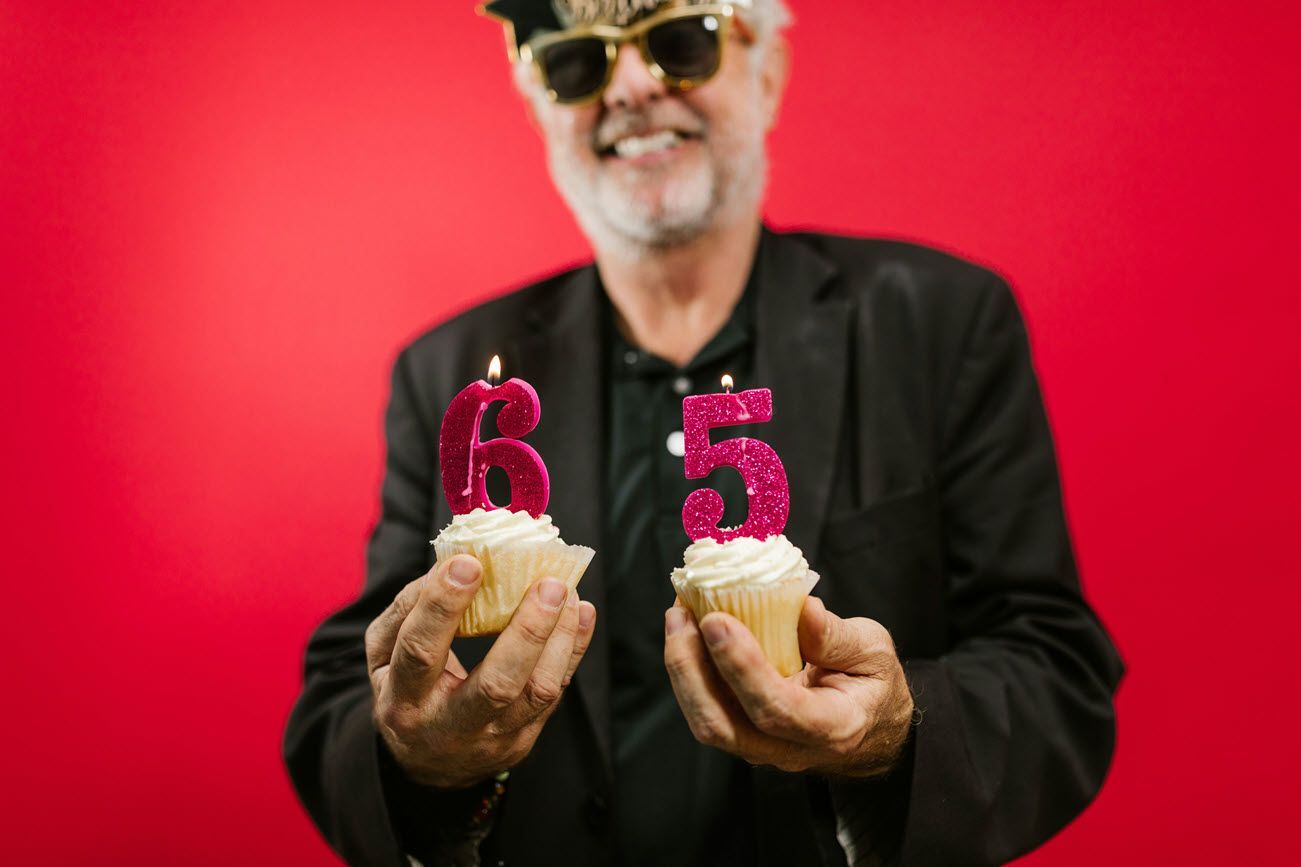

Dr. Votava advises initiating Medicare planning by age 64 to ensure a smooth transition. Early planning allows ample time to assess options, gather necessary information, and make informed decisions without the pressure of impending deadlines.

In conclusion, while Medicare offers essential health coverage for seniors, its complexity necessitates careful navigation. Partnering with a trusted Medicare agent can provide clarity, prevent costly mistakes, and offer peace of mind as you embark on this new chapter of healthcare coverage.

If you need assistance finding a reputable Medicare agent or have further questions about Medicare options, please let us know. We are here to help at (615) 249-1925!